Please click on the table to enlarge it.

Please click on the table to enlarge it.

Wednesday, 25 February 2009

Bleak economic outlook undermines sterling

Sterling reversed much of Monday’s gains yesterday, as investors remain wary about the bleak economic outlook facing the UK and about the likelihood of the Bank of England using quantitative easing to rejuvenate the economy. Bank of England policymaker, Andrew Sentance, confirmed that quantitative easing was necessary in the UK to get the economy back on track. These comments came alongside another bleak housing report from the British Bankers Association, which showed that mortgage approvals are down 43% in January compared to the same month last year. Figures released by the Office of National Statistics also showed that business investments fell at the fastest annual rate since 1991 in the fourth quarter of last year.

In early trading today, sterling is up against the single currency on improved stock market sentiment, following comments on both sides of the Atlantic that US and British banks will not be fully nationalised going forward.

Germany has released its GDP data as expected this morning, revealing a 2.1% decline in their GDP in the fourth quarter of 2008. Later this morning, the UK releases GDP figures.

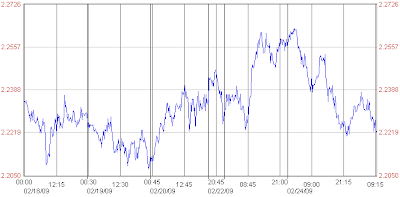

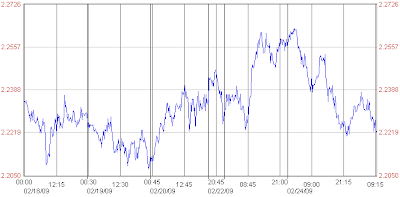

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

In early trading today, sterling is up against the single currency on improved stock market sentiment, following comments on both sides of the Atlantic that US and British banks will not be fully nationalised going forward.

Germany has released its GDP data as expected this morning, revealing a 2.1% decline in their GDP in the fourth quarter of 2008. Later this morning, the UK releases GDP figures.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

Cable remains firm around 1.45

Sterling weakened against the dollar yesterday on the back of grim US data, with figures showing US consumer confidence dropped to another record low in February, while a survey showed US home prices falling at a record pace in December. The pound was also weighed down by further bleak housing figures from the British Bankers Association, and renewed speculation about quantitative easing in the UK.

However, the pound strengthened against the dollar yesterday evening and overnight, as risk appetite got a boost in the New York session from Bernanke’s comments that major US banks may not need to be nationalised. Bernanke also suggested that if the stimulus plan is successful it could begin to pull the US economy out of the recession by the end this year, although he cautioned that policymakers expect a full recovery to take two to three years.

In the UK today Gross Domestic Product figures will be released at 09.30 GMT. In the US, Existing Home Sales data will be announced at 15.00 GMT this afternoon.

GBPUSD: 1 week chart. Click on graph to enlarge.

GBPUSD: 1 week chart. Click on graph to enlarge.

However, the pound strengthened against the dollar yesterday evening and overnight, as risk appetite got a boost in the New York session from Bernanke’s comments that major US banks may not need to be nationalised. Bernanke also suggested that if the stimulus plan is successful it could begin to pull the US economy out of the recession by the end this year, although he cautioned that policymakers expect a full recovery to take two to three years.

In the UK today Gross Domestic Product figures will be released at 09.30 GMT. In the US, Existing Home Sales data will be announced at 15.00 GMT this afternoon.

GBPUSD: 1 week chart. Click on graph to enlarge.

GBPUSD: 1 week chart. Click on graph to enlarge.

Dollar down on improved risk appetite

The euro strengthened against the US dollar yesterday amid renewed risk appetite, as US stocks made their strongest gains in a month after Federal Reserve Chairman Ben Bernanke said that troubled US banks may not have to be nationalised. Bernanke did warn that the success of the $787 billion stimulus package would be essential to ending a downward economic spiral, but suggested that if the stimulus plan is successful it could begin to pull the US economy out of a severe recession by the end this year.

German GDP figures released this morning showed the German economy shrank by 2.1% in the fourth quarter of 2008, its largest contraction since the country was reunited in 1990. The fall marked the third quarter of economic decline in a row and suggested that Germany was in the midst of its worst recession since the Second World War. However, the data has had little impact on the euro this morning, as it confirmed figures released earlier in February.

There are no further major releases due from the eurozone today. In the US MBA Mortgage Applications and Home Sales data will be released this afternoon. Bernanke will also be giving a Monetary Policy Report to the US House Panel at 15.00 GMT today.

EURUSD: 1 week chart. Click on graph to enlarge.

EURUSD: 1 week chart. Click on graph to enlarge.

German GDP figures released this morning showed the German economy shrank by 2.1% in the fourth quarter of 2008, its largest contraction since the country was reunited in 1990. The fall marked the third quarter of economic decline in a row and suggested that Germany was in the midst of its worst recession since the Second World War. However, the data has had little impact on the euro this morning, as it confirmed figures released earlier in February.

There are no further major releases due from the eurozone today. In the US MBA Mortgage Applications and Home Sales data will be released this afternoon. Bernanke will also be giving a Monetary Policy Report to the US House Panel at 15.00 GMT today.

EURUSD: 1 week chart. Click on graph to enlarge.

EURUSD: 1 week chart. Click on graph to enlarge.

Aussie dollar pares losses

The Australian dollar recovered most of its previous day’s losses against sterling yesterday, after comments from Fed Chairman, Ben Bernanke, that banks were likely to remain healthy without being nationalised caused a surge on Wall Street. This helped stem extreme risk aversion, although associated comments from Bernanke kept investor sentiment fragile. In the UK economic data was mixed, with CBI figures showing retail sales had fallen at a much slower pace than expected, while other data revealed investment had fallen at its fastest pace since the early 1990's and mortgage approvals were down over 40 percent on a year ago. Investors are today likely to focus on preliminary growth data for the UK. Markets are expecting the figures to reveal that the British economy has shrunk at a faster pace than had initially been forecast.

GBPAUD: 1 week chart. Click on graph to enlarge.

GBPAUD: 1 week chart. Click on graph to enlarge.

GBPAUD: 1 week chart. Click on graph to enlarge.

GBPAUD: 1 week chart. Click on graph to enlarge.

Kiwi dollar firms on improved equities

The New Zealand dollar gained some support yesterday, as a rebound in equity markets eased investor risk aversion. This has continued into today's trading and until January trade data and the NBNZ business outlook survey are announced tomorrow, the kiwi will continue to be directed by broader market movements.

GBPNZD: 1 week chart. Click on graph to enlarge.

GBPNZD: 1 week chart. Click on graph to enlarge.

GBPNZD: 1 week chart. Click on graph to enlarge.

GBPNZD: 1 week chart. Click on graph to enlarge.

Subscribe to:

Comments (Atom)