There are no major announcements due in the UK today, whilst the eurozone reveals their Consumer Price Index figures this morning, giving an indication of inflation at present.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPUSD: 1 week chart. Click on graph to enlarge.

GBPUSD: 1 week chart. Click on graph to enlarge.

EURUSD: 1 week chart. Click on graph to enlarge.

EURUSD: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPUSD: 1 week chart. Click on graph to enlarge.

GBPUSD: 1 week chart. Click on graph to enlarge.

EURUSD: 1 week chart. Click on graph to enlarge.

EURUSD: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPEUR: 1 week chart. Click on graph to enlarge.

GBPUSD: 1 week chart. Click on graph to enlarge.

GBPUSD: 1 week chart. Click on graph to enlarge.

EURUSD: 1 week chart. Click on graph to enlarge.

EURUSD: 1 week chart. Click on graph to enlarge.

GBPAUD: 1 week chart. Click on graph to enlarge.

GBPAUD: 1 week chart. Click on graph to enlarge.

GBPNZD: 1 week chart. Click on graph to enlarge.

GBPNZD: 1 week chart. Click on graph to enlarge.

USDJPY: 1 week chart. Click on graph to enlarge.

USDJPY: 1 week chart. Click on graph to enlarge. EURUSD: Today's trading. Click on graph to enlarge.

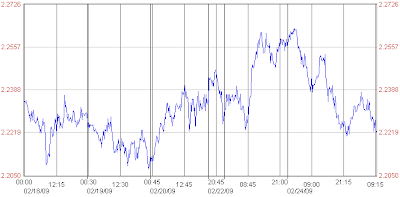

EURUSD: Today's trading. Click on graph to enlarge.

GBPEUR: Today's trading. Click on the graph to enlarge.

GBPEUR: Today's trading. Click on the graph to enlarge. GBPUSD: Today's trading. Click on the graph to enlarge.

GBPUSD: Today's trading. Click on the graph to enlarge.

GBPEUR: 1 week chart. Please click on graph to enlarge.

GBPEUR: 1 week chart. Please click on graph to enlarge.

GBPUSD: 1 week chart. Please click on chart to enlarge.

GBPUSD: 1 week chart. Please click on chart to enlarge.

EURUSD: 1 week chart. Please click on graph to enlarge.

EURUSD: 1 week chart. Please click on graph to enlarge.

GBPAUD: 1 week chart. Please click on chart to enlarge.

GBPAUD: 1 week chart. Please click on chart to enlarge.

GBPNZD: 1 week chart. Please click on graph to enlarge.

GBPNZD: 1 week chart. Please click on graph to enlarge.

In response to the Bank of England’s decision to cut interest rates by 0.5% to a new historic low of 1% yesterday, the pound has regained value against the single currency as markets reacted positively to the move. The European Central Bank also acted as expected and kept interest rates on hold at 2%. Housing numbers from the Halifax house price index also surprised to the upside earlier on Thursday, with a rise in prices of 1.9 percent in January, with many anticipating they would have fallen further. In early trading today the pound has risen further against the euro, hitting a 2 month high as investors hold on to the belief that the UK’s interest rates may be nearing the bottom, whereas the eurozone has much further to fall. It must be noted, however, that an underlying nervousness still remains over the state of the UK’s economy and how deep a recession we may be facing.

Germany release their industrial production figures this morning, whilst within the UK, industrial and manufacturing data is released.

The pound strengthened against most of the major currencies yesterday following the Bank of England’s decision to cut interest rates by 50 basis points to 1%. Usually currency weakens on the back of interest rate cuts, however the opposite has occurred on this occasion as investors’ believe it points to a positive economic stimulus.

The pound reached a two-week high against the dollar, although experts believe this will be short lived with many predicting losses versus the greenback over the next few months. It hit a 23-year low just last month.

There are several significant announcements taking place in the US today including Nonfarm Payrolls, Average Hourly Earnings, Average Weekly Hours and Unemployment Rate at 13.30 GMT. In the UK, Industrial Production and Manufacturing Production data will be released at 09.30 GMT.

The dollar strengthened over the euro by 0.59 cents yesterday to close the day at 1.2791, after rumors that the Securities and Exchange Commission is going to relax some accounting rules saw US stocks rally. This had the effect of improving risk appetite in the foreign exchange markets and saw the euro come off its earlier low of 1.2765, which it had been pushed to after lingering pressure from the downgrading of Russia's sovereign debt.

In today's trading there has been little change as investors wait for the announcement of a barrage of important US employment data. Announced at 13.30 GMT, Average Hourly Earnings, Non-farm Payrolls and Unemployment Rate figures will give a clear indication of the health of the US employment market and some investors speculate that we will notice a slowing in the rate of contraction. In the eurozone German Industrial Production data is announced this morning.

In a scheduled announcement the Bank of England has cut British interest rates by 0.5%, reducing the Bank's target rate from 1.5% to 1%. The decision was in line with investors' expectations, who were anticipating a cut of at least 0.5%. This rate cut sets a new all time low for the Bank of England.

The pound rallied against the single currency yesterday due to a broad-based improvement in investors' appetite for perceived riskier assets on the back of stronger-than-expected service sector data across the globe. Indeed, PMI services data out of the UK rose to 42.5 in January from 40.2 the previous month, and higher than market forecasts of 40.4.

The euro's slide yesterday was accelerated after Fitch Ratings downgraded Russia's long-term foreign and local currency ratings to triple-B, sparking fears of a deep downturn in Eastern Europe. Capital outflows from Russia put pressure on the rouble, forcing Russian authorities to sell euros to maintain the balance of their euro-dollar currency basket.

The major news today will surround the interest rate decisions due from the Bank of England and European Central Bank. The market is anticipating a 0.5% cut from the BoE, whilst the ECB is expected to keep rates on hold at 2%. Any unexpected move from either central bank could lead to a weakening of the currencies.

The pound has lost ground to the US dollar this morning, as investors expect the Bank of England to cut interest rates to another record low this afternoon. Sterling has traded in a very volatile fashion this week, alternately undermined by Moody's downgrade of Barclays and buoyed by a slightly less bleak outcome than expected from a round of economic data, including British service sector numbers. Overall though, underlying nervousness at the vulnerable state of Britain's financial sector and broader economy has kept sentiment weak.

A 0.5% rate cut from the BoE has already been priced in, but some investors are speculating that the central bank may cut rates by a full percentage point to stave off a deepening recession.

The US dollar strengthened over the euro by 1.91 cents yesterday to close the day at 1.2847. A report on the health of the US manufacturing sector showed that activity had not fallen as much in January as expected, which gave the dollar some strength. Coupled with this was news that US private sector job losses had slowed slightly in January. The euro's position was also undermined by news of a downgrade in Russia's sovereign debt due to low commodity prices, dwindling reserves and corporate debt problems.

In today's trading the dollar has pushed slightly lower but the rate has steadied ahead of the ECB's interest rate announcement at 12.45 GMT this afternoon. Investors expect the central bank to keep interest rates on hold at 2% this month, with further cuts potentially made at a later date. Other announcements in the eurozone include German Factory Orders figures, whilst in the US Jobless Claims, Nonfarm Productivity and Factory Orders data is released.

The dollar weakened yesterday as traders began investing in riskier higher yielding currencies following positive US housing data. There was limited trading in anticipation of the interest rate decisions from the Bank of England and the European Central Bank tomorrow. The ECB is likely to maintain interest rates at 2%, whilst the Bank of England is expected to cut further by up to 100 basis points. Usually a currency is weakened by interest rate cuts, but there is speculation that the pound may instead strengthen on the back of any cuts as the move points to a positive economic stimulus.

The pound also strengthened yesterday following a report on the UK construction sector, which showed that it rose to 34.5 in January from the 12 year low of 29.3 set in December.

There are several significant announcements taking place in the US today including ADP Employment Change and MBA Mortgage Applications. In the UK, the BRC Shop Price Index will be released at 10.00 GMT.

The pound remained under broad selling pressure against the single currency yesterday, as poor economic fundamentals and a looming interest rate cut took its toll on sterling. Data released early on Tuesday showed the construction industry rose to 34.5 in January after a fall to 29.3 in December. But that was the 11th month running the index has been below 50, the level which marks contraction, confirming the poor state of the UK’s economy at present. Investors are also wary of another interest rate cut tomorrow, with the Caxton FX analysts forecasting a 0.5% cut by the Bank of England to another historic low of 1%, whilst the European Central Bank are expected to keep rates on hold at 2%.

Retail sales figures are released in the eurozone this morning, whilst PMI services data is released in the UK and the eurozone.

The US dollar slipped against the euro yesterday as investors sold the safe haven dollar on the back of a positive US housing report and action by the Federal Reserve aimed at underpinning liquidity amid the global financial crisis.

The National Association of Realtors struck an unexpected note of hope for the devastated US housing market, in a deepening slump since 2006. NAR reported pending home sales rose 6.3 percent in December, confounding most private economists' expectations of a flat reading. In addition, the Federal Reserve announced a six month extension of temporary programmes designed to inject liquidity into the financial markets.

Eurozone Retail Sales and PMI Services data is released this morning, while in the US employment data and MBA Mortgage Applications figures are released this afternoon.